One of the main responsibilities of the Trustee is to monitor the finances of the Fund to make sure there’s enough money to pay all of the benefits promised to members, both now and for many years into the future.

In part, this is achieved through a review of the funding position. A comprehensive review, known as an Actuarial Valuation (Valuation), is completed every three years by a qualified and independent Actuary. The most recent Valuation of the Fund was carried out at 31 March 2022. In between these full valuations, annual interim funding reviews are carried out.

The aim of the Valuation is to assess the funding position of the Fund. To do this the Actuary has to determine:

The funding position is calculated on an ongoing basis and on a solvency basis:

The funding position is a ‘snapshot’ of the Fund on a single day. However, in practice the liabilities are paid over a very long period of time. In fact, some of the liabilities may not be paid for another 30 or 40 years. Several factors can affect the funding position, including life expectancy, investment performance, interest rates and inflation levels. The Fund’s assets are invested over the long-term, and therefore, fluctuations in funding levels are to be expected.

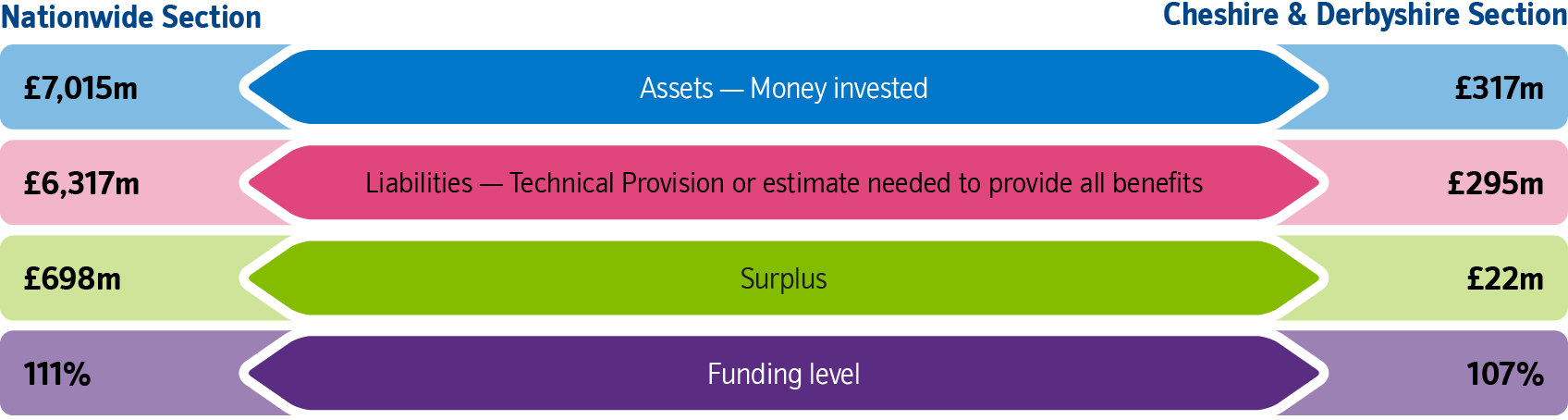

The formal Valuation results at 31 March 2022 are shown below. You’ll see that the Nationwide Section had a surplus of £698 million and the Cheshire & Derbyshire Section had a surplus of £22 million at 31 March 2022.

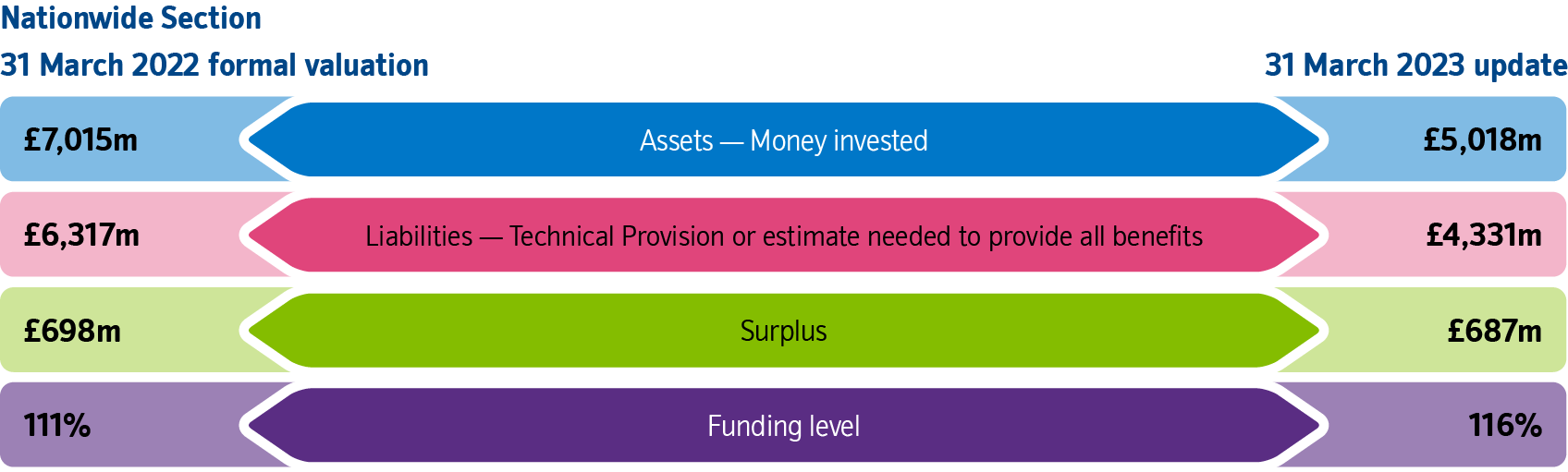

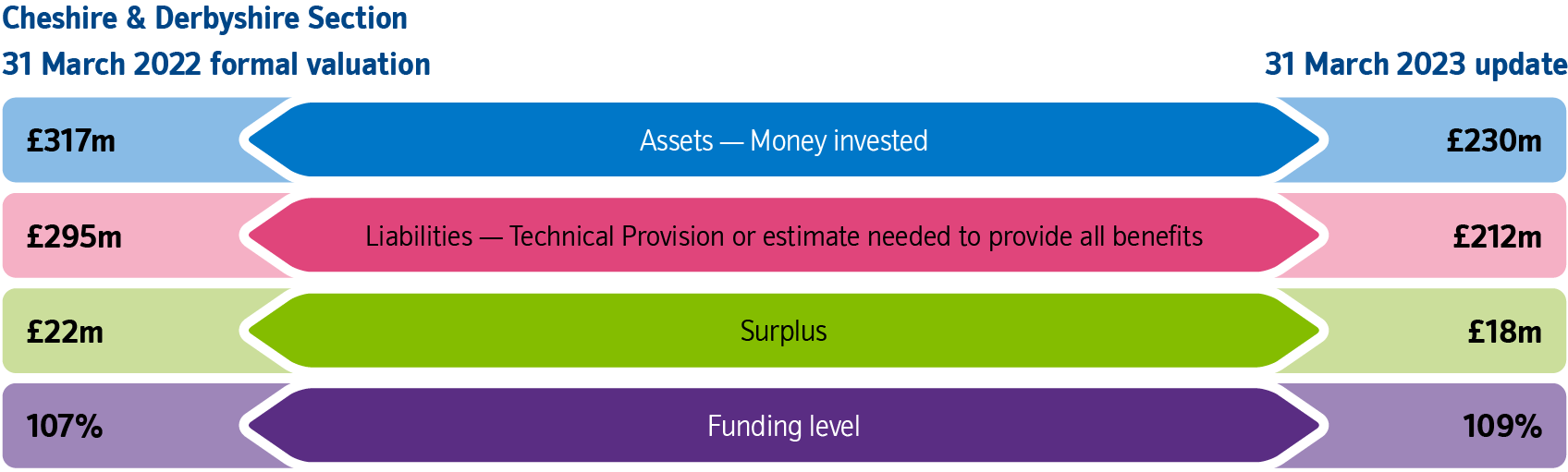

As the Valuation is only undertaken every three years, at 31 March in each intervening year the Actuary undertakes further estimates of the financial health of the Fund (an interim funding position). These use the 2022 Valuation assumptions, and then updates them to allow for the changes in market conditions.

The position at 31 March 2023 was similar to that at 31 March 2022, with both Sections remaining in surplus. Over the year to 31 March 2023 there were significant increases to UK government bond yields. The impact of this was to reduce both the value of the assets and the amount of money needed to provide the benefits (liabilities) for both Sections. The results of the interim funding update at 31 March 2023 are shown below:

You should be aware that the funding level of both Sections will vary over time and the Trustee will continue to regularly monitor the funding positions.

As both the Nationwide and Cheshire and Derbyshire Sections of the Fund are in surplus on the technical provisions basis, no deficit contributions are currently due. This position will be reviewed at each future valuation.

In addition, following the 31 March 2019 valuation the Society agreed to provide a Contingent Asset to the Nationwide Section of the Fund to provide increased security for members’ benefits. This security is available to the Fund in the event that additional funding is required in the future above the level that the Society is able to provide.

As part of the full Valuation, the Actuary works out what would have happened if the Fund had been wound up on the Valuation date. This is known as a solvency Valuation where the Actuary estimates if there’s enough money to buy individual insurance policies to provide full pensions for every member. At 31 March 2022 the estimated solvency deficit was £2,721m for the Nationwide Section and £17m for the Cheshire & Derbyshire Section.

Since 31 March 2022 the solvency position has improved for both Sections as a result of rising bond yields. At 31 March 2023 the actuary estimated that the Nationwide Section solvency deficit had reduced to £1,567m and the Cheshire and Derbyshire Section's deficit had reduced to £3m.

The funding level on a solvency basis is lower than on the ongoing basis as the cost of providing all members’ benefits straight away through insurance policies (pension annuities) is much higher than paying for them over the future life of the Fund. Also, insurance companies are required by law to take a very cautious approach to pricing pension annuities, which includes setting aside extra capital and reserves. In addition, their prices will include their costs and a profit margin.

In the unlikely event that the Fund is wound up and the Contingent Asset and further contributions from the Society were insufficient to meet any shortfall (for example because the Society became insolvent) additional security is provided through the Pension Protection Fund (PPF), which has been set up by the Government to assist schemes in such circumstances. The PPF would normally take over the Fund and pay compensation to members. More information is available on their website at www.ppf.co.uk

This is a legal requirement. It doesn’t mean the Society is thinking of winding up the Fund, or that the Trustee has any reasons to expect the Society to become insolvent.

Legislation requires the Trustee to say whether any surplus funds have been paid to the Society from the Fund in the period since the last Summary Funding update was issued. The Trustee can confirm that there has not been any such payment over the period. The Trustee can also confirm that the Fund has not been modified by The Pensions Regulator, or had any directions or Schedule of Contributions imposed by it.